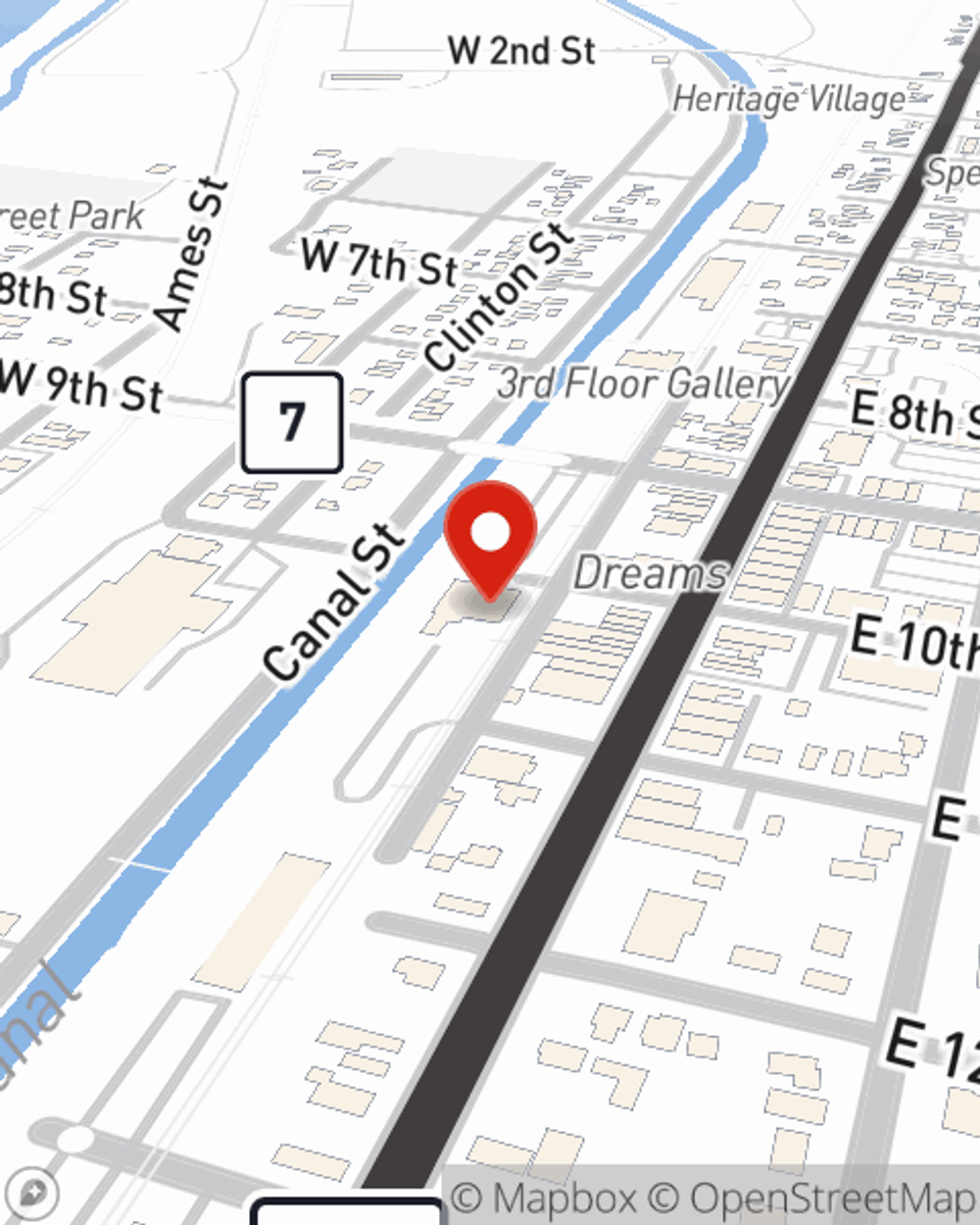

Renters Insurance in and around Lockport

Renters of Lockport, State Farm can cover you

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Lockport

- Homer Glen

- Joliet

- Frankfort

- New Lenox

- Mokena

- Tinley Park

- Orland Park

- Orland Hills

- Romeoville

- Burr Ridge

- Oak Lawn

- Oak Forest

- Lemont

- Woodridge

- Plainfield

- Cook County

- Will County

- Kankakee County

- Dupage County

- Bolingbrook

- Springfield

- Manhattan

- Elwood

Calling All Lockport Renters!

The place you call home is the cornerstone for everything you hold dear. It’s where you build a life with the ones you love. Home is truly where your heart is. That’s why, even if you live in a rented townhome or home, you should have renters insurance—whether or not your landlord requires it. It's coverage for the things you do own, like your antique collection and stereo... even your security blanket. You'll get that with renters insurance from State Farm. Agent Susie Sheehan can roll out the welcome mat with the knowledge and competence to help you make sure your stuff is protected. Personalized care and service like this is what sets State Farm apart from the rest. When you're covered by State Farm, your rental can be home sweet home.

Renters of Lockport, State Farm can cover you

Renting a home? Insure what you own.

Why Renters In Lockport Choose State Farm

Many renters underestimate the cost of refurnishing a damaged property. Your valuables in your rented property include a wide variety of things like your set of favorite books, tool set, smartphone, and more. That's why renters insurance can be such a good move. But don't worry, State Farm agent Susie Sheehan has the efficiency and dedication needed to help you understand your coverage options and help you protect your belongings.

Get in touch with Susie Sheehan's office to discover the advantages of State Farm's renters insurance to help keep your valuables protected.

Have More Questions About Renters Insurance?

Call Susie at (815) 306-0184 or visit our FAQ page.

Simple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Susie Sheehan

State Farm® Insurance AgentSimple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.